Introduction: The Ever-Changing Landscape of American Mortgage Consultations

Navigating the world of mortgages can feel like trying to find your way through a maze. With terms like “APR,” “escrow,” and “forbearance” thrown around, it’s easy to understand why many first-time homebuyers feel overwhelmed. Enter the American mortgage consultant: your trusty guide through this winding pathway. Keeping up with mortgage news isn’t just for real estate aficionados; it’s crucial for anyone looking to buy a home or refinance their current mortgage. So, buckle up as we dive into the latest updates and insights from the fascinating world of mortgage consultants!

Understanding the Mortgage Market

Current Mortgage Trends: What’s Hot and What’s Not

In the ever-evolving mortgage landscape, staying on top of trends is essential. Currently, fixed-rate mortgages are still preferred for their predictability, but adjustable-rate mortgages (ARMs) are catching attention with lower initial rates. Moreover, there’s a growing interest in non-traditional lending options, as more people explore creative financing solutions.

Interest Rates: The Rollercoaster Ride Continues

Interest rates have been on an emotional rollercoaster this year, with fluctuations that sometimes seem like a game show. Though they may be stabilizing, buyers and homeowners alike are anxious about potential hikes and what they mean for their financial future. Consulting with a mortgage professional can help decode the mystery behind these changes.

The Role of American Mortgage Consultants

Who Are They? A Brief Overview

American mortgage consultants are your go-to experts in the intricate world of home financing. Armed with knowledge about various loan products, market trends, and regulations, they create tailored solutions to suit your unique financial situation. Think of them as your financial matchmakers—finding you the best loan to fit your needs.

The Importance of Mortgage Consultants in Today’s Market

In today’s fast-paced market, having a knowledgeable consultant is invaluable. They not only save you time but also help you avoid costly mistakes, providing peace of mind in what can be a disruptive process.

Latest News from American Mortgage Consultants

Breaking News: Recent Changes in Regulations

Regulatory changes can unfold like plot twists in a soap opera. Recently, new guidelines have emerged, impacting lending practices and qualifications. From adjustments in credit score requirements to shifts in debt-to-income ratios, staying informed can make all the difference in securing that dream home.

Insightful Updates from Industry Leaders

Industry leaders continually share insights that help shape trends. This year, many mortgage consultants report a focus on customer service, including streamlined processes and better communication. Happy clients may just be the best marketing tool!

Innovations in Mortgage Consulting

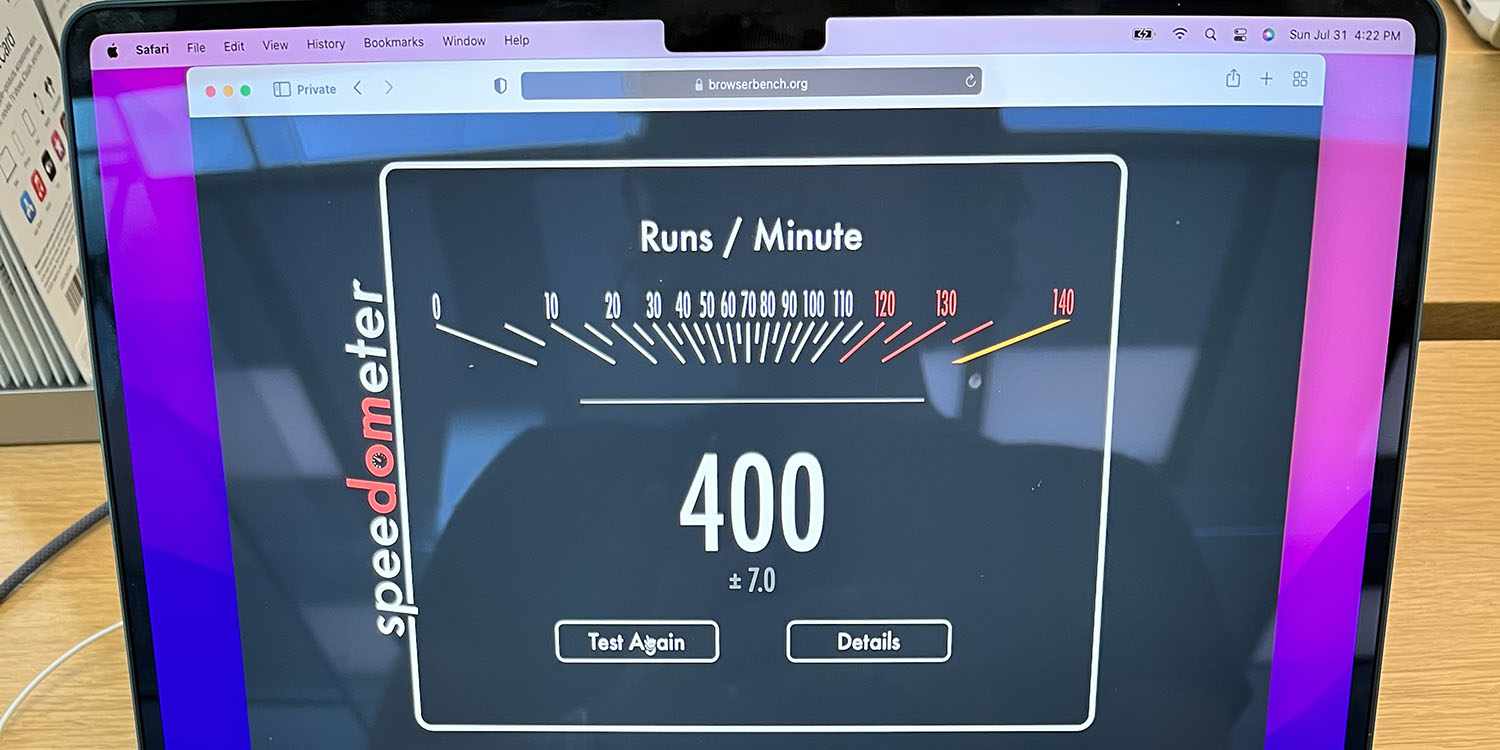

Tech Talk: Embracing Digital Solutions

The digital age has transformed mortgage consulting like never before. Online applications, virtual consultations, and digital document storage make the process more efficient. Consultants employing these technologies are poised to attract a tech-savvy clientele eager for a seamless experience.

Artificial Intelligence in Mortgage Consulting: Friend or Foe?

AI is making waves in lending, helping consultants analyze data and customize loans for clients. While some fear robots taking jobs, AI’s role is to enhance—not replace—the human touch. Think of it like the friendly sidekick in every superhero movie.

Green Mortgages: Sustainability in Financing

Eco-conscious buyers now have options that align with their values. Green mortgages offer reduced rates for energy-efficient homes, promoting a sustainable future. It’s a win-win for the environment and your wallet!

Client Testimonials: Real-Life Impact of Consultants

Success Stories: How Consultants Changed Lives

Nothing illustrates the power of mortgage consulting better than heartfelt stories from satisfied clients. From families achieving homeownership dreams to individuals successfully refinancing and lowering monthly payments, these narratives showcase life changes that matter most.

Humor in Experience: The Lighter Side of Mortgage Consultations

Not every encounter in the mortgage world is serious business. Clients often recount humorous moments that lighten the load—like the client who mistook “escrow” for a vacation destination! It reminds us not to take our financial journeys too seriously; laughter often paves the way in stressful times.

Challenges Facing the Mortgage Industry Today

Navigating Refinancing During Economic Shifts

Refinancing can feel like an uphill battle during economic changes. Many homeowners are uncertain about whether it’s the right time to act. A knowledgeable mortgage consultant can offer tailored strategies to find the right approach for individual circumstances.

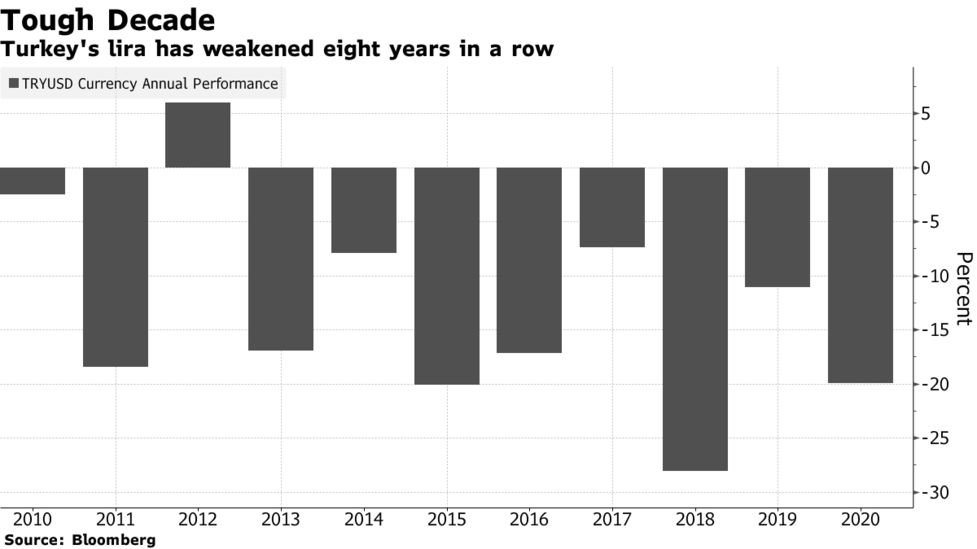

The Impact of Inflation on Mortgage Rates

Inflation and mortgage rates often dance together. As inflation rises, so do rates, affecting home affordability. Understanding this dynamic is vital for both buyers and consultants working in the trenches.

Market Predictions: What Lies Ahead?

Expert Opinions: Who’s Predicting What?

Various experts make predictions about where the market is heading. Some anticipate a leveling off of prices, while others predict an increase in housing supply. These insights help consultants guide clients through uncertain times.

Understanding Economic Indicators

Economic indicators, such as employment rates and GDP growth, play a crucial role in shaping the mortgage landscape. Consultants must stay informed about these indicators to provide the best advice possible.

Educational Resources: Empowering Clients

Workshops and Webinars Offered by Consultants

Many mortgage consultants are stepping up their game by hosting informative workshops and webinars. These sessions cover essential topics, from understanding credit scores to making sense of mortgage jargon.

Helpful Online Resources for Home Buyers

The internet is a treasure trove of information for homebuyers. From blogs to calculators, consultants often recommend quality resources to tool their clients for success.

The Role of Social Media in Mortgage Consulting

Leveraging Social Media: Connecting with Clients

Social media has become invaluable in the mortgage industry, allowing consultants to reach potential clients and share insights. It also offers a platform for fostering community and engaging in discussions on trending topics.

Memes and Mortgages: Adding Humor to Serious Business

Mortgage memes are all the rage! A little humor goes a long way in making the heavy topic of mortgages more relatable. Expect giggles and shares as consultants lighten the mood with a clever image or two.

Legal Considerations in Mortgage Consulting

Understanding Compliance: A Necessary Evil

Navigating the sea of compliance regulations can be daunting. Consultants must keep abreast of laws to protect their clients and themselves. Think of it as the fine print nobody reads but everyone should!

What Clients Should Know About Their Rights

Knowledge is power. Clients must understand their rights during the mortgage process, ensuring they’re properly represented. A good consultant will clarify these rights, fostering transparency in every interaction.

Client Engagement Strategies

Building Trust: The Consultant-Client Relationship

Building trust is vital in the consultant-client relationship. Effective communication, empathy, and transparency make clients feel secure, turning them into loyal advocates for the consultant’s services.

Communication Tactics: How Consultants Keep Clients Informed

Regular updates and check-ins can help clients feel in control. Consultants can utilize various tools—like newsletters or personalized messages—to ensure their clients are always in the loop.

Mortgage Myths Debunked

Separating Fact from Fiction: Common Misconceptions

Myths abound in the mortgage world! For example, many believe they need a 20% down payment to qualify for a loan. Consultants work to debunk these myths, empowering clients with real information.

The Real Scoop: What Everyone Gets Wrong

Clarifying misconceptions can prevent significant financial missteps. For instance, knowing how credit scores affect mortgage rates can help clients pave the way to better deals.

The Future of Mortgage Consulting

Predictions for 2025 and Beyond

As the mortgage landscape continues to evolve, consultants must adapt. Predictions indicate increased digitization, innovative products, and a closer focus on customer experience. Those who embrace change will thrive.

Adapting to Consumer Demands: A Consultant’s Advantage

Staying attuned to consumer preferences is essential. Whether it’s offering virtual consultations or personalized mortgage options, consultants need to provide what clients are genuinely seeking.

Conclusion: The Ongoing Journey of Mortgage Consulting

Throughout our exploration, we’ve seen that American mortgage consultants play an integral role in guiding clients through an ever-changing market. The updates, innovations, and successes shared here highlight the importance of staying informed and empowered in financial decisions.

Call to Action: Connect with Your Consultant Today!

Thinking of buying a home or refinancing? Don’t hesitate—reach out to a mortgage consultant who can provide tailored advice and support you on your journey. After all, armed with the right information and a sprinkle of humor, navigating the mortgage maze can be a lot more enjoyable!